- call us +1 (213) 338-7961

When you first decide to open your own business, you’ll have to find a way to get it off the ground. Most new businesses pay initial costs with startup funds from two main sources: small business loans and personal savings. You may be able to obtain a loan Learn your options for funding your small business. Business can be any type of Business either Online or Service rendered business, we are there for you.

Majority of the SBA CDC/504 loans are financed against security of a property. In case you do not own any property you can still get a loan on the security of any other financial movable asset like bank fixed deposit, National Saving Certificates, Shares of approved listed companies, units of mutual funds scheme and insurance polices with good surrender value. and proves of online business showing all documentations.

However majority of the business loans are financed against security of an immovable property. Amongst immovable properties we are more comfortable in lending against residential, commercial properties or proves of online Documentations. We are normally reluctant in lending against any plot of land due to issues like encroachment of such plots.

The rate of interest charged by us are relatively lower than those charged by lots of Loan companies. These SBA CDC/504 loans are generally taken for the purpose of working capital needs of the business.

In some of the cases the immovable property is secured and provided as collateral for the term loans taken for the purpose of capital expenditures like construction of factory building or purchase of plant and machinery.

These loans against property are generally secured by equitable mortgage of the property where the borrower deposits the original title documents with the lender without much of the documentations.

In case of loans against property, we normally gets the valuation of the property done to arrive at the valuation figure of the property. We will normally lend you around 80% of the value of the property so arrived at by the valuer.

Grow your small firm or large-scale company with SBA CDC/504 loans.

Our SBA CDC/504 loans come with a host of benefits and are tailormade to meet your unique business needs.

We offer among the best SBA CDC/504 loans in the world, with complete transparency and competitive interest rates. Also, our business loans do not require any security.

Pacific Asian Consortium rates no or low upfront and ongoing auto fees as one of the leading features in any SBA CDC/504 loans. “Many people base their Persoanl decision on the interest rate being charged, but they should also ask about all fees,” We give the cheapest and best Loan rates. For as low as 6.33%

Pacific Asian Consortium Company offers you the capacity to choose how often you repay (weekly, fortnightly or monthly) and gives you greater control of your finances and planning. Payments should also include the ability to pay through multiple options including the internet, phone or an ATM.

Pacific Asian Consortium Company offers you the fastest loan, most client get their loan in few days after applications, some got theirs while on the bed the next day. We are truly the fastest.

This option enables a break from making your loan repayments for those occasions where you may need to direct your cash elsewhere. We may provide a repayment holiday of between three to 12 months if you’ve made enough additional repayments.

"You are eligible for a Business loan if you are a salaried individual, self-employed individual (own business), or a self-employed professional (doctor, lawyer, etc.). Other factors such as your income, age, residence, work experience, repayment capacity, past obligations and place of work are also taken into account. A SBA CDC/504 loans can be used for any purpose provided it is legitimate; you need not mention the end use to the us."

While deciding on the loan amount eligibility we will always evaluate your ability to service the SBA CDC/504 loans taken so the value of the property only is not relevant for such loans. So your eligibility to get these SBA CDC/504 loans will also be constrained by your income. Normally we grant loans equal to your two years income subject to a margin of 80% of the value of the property.

While granting the loan you need to provide certain document so as to comply with the KYC (Know your customers) norms. This includes your address proof, proof of your income in the form of copy of return of income. In case of salaried employees the form no. 16 will be sufficient.

We prescribe a minimum age of 21 years and maximum age of 85 years for SBA CDC/504 loans. But these criteria are not set in stone. If you prove your income earning capability, we are willing to overlook this factor.

We evaluate the number of years staying in the same residence, which can be rental or owned place for your business. If you are staying as a paying guest, you are also eligible to get the loan. We have set geographical limits – customers living beyond this point simply aren’t eligible for the loan. Please contact Customer Services for more details on geographical limits.

We often internally term certain areas in a city as high-risk. These areas typically report high crime rates and lesser safety. If you happen to stay in such an area, you may find it difficult to get an Business loan. We do not publicly admit to such classifications for many obvious pragmatic reasons.

This is the most important criteria for a SBA CDC/504 loans. We evaluates your repayment capacity based on your income, savings, and debt obligations, other than household expenses.

Based on this information the we decides on the amount of loan that you are eligible, after considering your previous debts and obligations. We verifies income by scrutinizing your salary/income statements, Form, and bank statements.

The minimum income criterion for salaried individuals and self-employed is generally considered by one of our teams. The lower income criteria for the self-employed is because banks reckon that a self-employed person may be earning more but shows a lower income for tax-saving purposes.

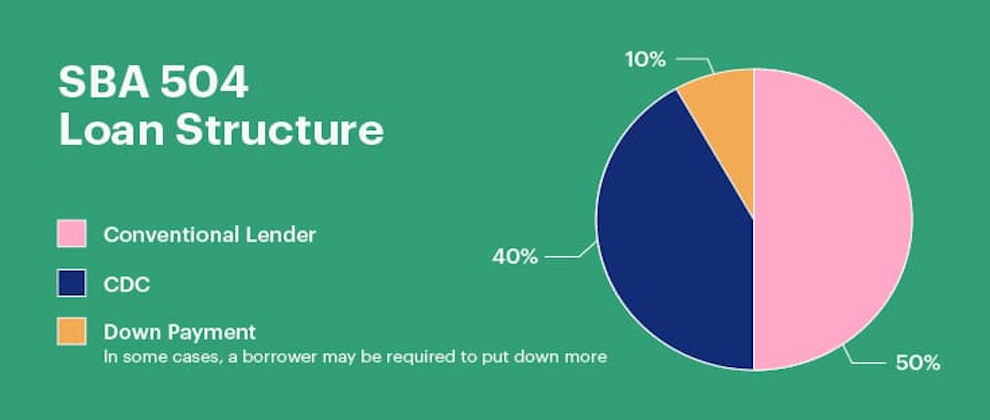

A down payment might be the one thing everyone knows is part of SBA CDC/504 loans process, but there is some discussion on how much of a down payment to make; how to fund it; and who benefits most from a big down payment: the buyer or US?

It seems obvious that the bigger the down payment, the better it is for the buyer and for good reason: It’s the first jab at reducing the amount of money you must borrow and thus reduces the amount you must repay.

Existing SBA CDC/504 loans customers can get a top-up loan with no documentation